I am struggling with the handling of GST for Bad Debt in Malaysia. The bank will provide a GST invoice to you and you can claim.

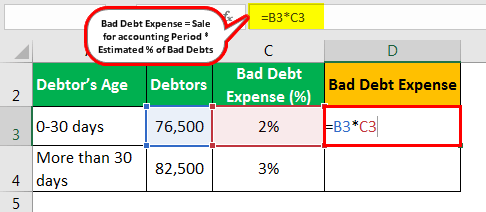

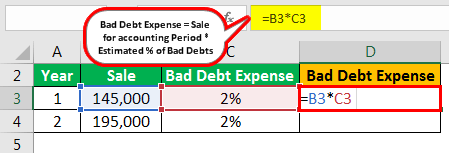

Bad Debt Expense Formula How To Calculate Examples

In normal situation you should claim bad debt relief on outstanding invoices that 6 month.

. ADJUSTMENT FOR OUTSTANDING AMOUNT DUE FROM BUYER BAD DEBT RELIEF 8. On the other hand if you as a customer have not paid your supplier within 12 months from the due date of payment you are required to repay to the Comptroller the input tax that you have previously claimed if any. Under purchase there is also bad debt relief where business did not do payment for supplier more than 6 months there for the input tax claim from 6 months ago will have to be return to Kastam so bad debt relief goes both waysthis is a fair rules.

GST on that is RM6000 Bad debt relief claimed would be RM6000 If the customer only makes partial payment of RM50000 then the GST recovered would be RM3000 or 6 of RM50000. Payment of tax is made in stages by the intermediaries in the production and distribution process. GST is also charged and levied on the importation of goods and services into Malaysia.

For the journal entry to be generated define the Date then click OK. Click on Create Bad Debt Relief 4. I have obtained a relief of bad debt before 01 June 2018.

Repayment of the tax should be accounted for at a standard rate of 6. Businesses can claim Input Tax once an Invoice is received from the supplier regardless if the business has paid for the Invoice. A requirements under s58 GSTA and Part X of GST Regulations 2014 are fulfilled.

A a copy of any tax invoice which was issued in accordance with part iv or where there was no obligation to issue a tax invoice a document which shows the time nature purchaser and consideration of the supply. Item 2Accounting for GST on imported services. Define the search criteria then click on Search 2.

And b the supply is made by a GST registered person to another GST registered person. In accordance with Section 58 of the Goods and Services Tax Act 2014 with effect from 2062016 if the bad debt relief is not claimed by the supplier in the immediate taxable period immediately after the expiry of the sixth month the notification to the Director General to defer such claims must be made through TAP. Per Malaysia GST regulations GST will be applied to the bank charge.

You can apply for bad debt relief from the Comptroller of GST for return of the output tax previously accounted for and paid by you. GST is a multi-stage tax on domestic consumption. The amount of GST is equivalent to 6 of the amount received from the customer.

Invoice amount is RM100000. Relief Date Journal Com n Amount x 31122015 ADVANCE. 7004001 ADVANCE Relief Date.

Any overpaid GST can be claimed under provision of subsection 41b Repeal Act. GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted. GST is also charged on importation of goods and services into Malaysia.

73 1 - goods and service tax regulation 2014 evidence required to support the claim for bad debt relief are. And iii The bad debt relief shall be claimed immediately in the taxable period after the expiry of the sixth month from the date of supply. All imported goods except goods prescribed as zero-rated and exempt or given relief from the payment of GST will be subject to GST.

For example you make payment to vendors and you must also pay bank fees to banks. Item 3Claiming bad debt relief. The bad debt relief processed and saved will be listed on the grid section for user view and track User can double click on the record line to view the list of outstanding invoices selected for the.

Relief Tax Amount F rom Account. Credit note issued received pertaining to GST charged and accounted on retention amount received paid on or after 1 September 2018 Input tax adjustment for bad debt relief Output tax adjustment for recovery of bad debt Output tax adjustment on outstanding amount due to suppliers for more than six 6 months from the date of supply. The bad debt relief may be claimed subject to.

Total Input Tax Inclusive of Bad Debt Relief other Adjustments 62. My understanding is that in the case of Output GST the declared amount of an invoice could be claimed after six months if the invoice is not paid by the. The Bad Debt Relief function is located at Accounting Journal Entry GST Bad Debt Journal AR Bad Debt Relief Bad Debt Relief Listing screen.

If user decide not to claim the GST bad debt relief they can choose to untick it. Thus a business will need to report and pay the Output Tax once an Invoice is issued rega. Any goods and services tax due overpaid or erroneously paid may be collected refunded or remitted.

Output Tax has to be reported either upon Invoice or Collection whichever comes first. Go to GST Manage AR Bad Debt 1. Go Back to EasyAccSoft.

11 rows Amendments. Bad debt relief 58. 1 subject to regulations made under this Act any person who is or has ceased to be a taxable person may make a claim to the Director General for a relief for bad debt on the whole or any part of the tax paid by him in respect of the taxable supply if.

700-9100 V Relief Amount Local Bad Debt Relief Details Diagnostic Relief Amoun t Relief Tax Amount Local 6000 6000 a Previous Record Home Next Record o Edit Task Close Close Vie w GST Advisor X. After 01 June 2018 my debtor repays the amount which I have been given relief. What is the GST rate applicable on my repayment of the tax due and payable after 01 June 2018.

Item 1Issuance of invoice before effective date for supply made on or after effective date. Check the document to claim bad debt relief. GST-Bad Debt Relief - Accounting Entry When you are Selling goods to customer with a Tax Invoice the double entry will be- Dr Debtor 212000 Cr Sales 200000 Cr Output Tax 12000 If you have not.

Fulfilled requirements under s58 GSTA 2014 where the person has not received any payment or part of the payment in respect of the taxable supply from the debtor after the sixth month from the date of supply and sufficient efforts have been made by him to recover the debt. However if after 6 months the business still h.

Gst Sales Purchase Deferred Tax Journal Adjustment Estream Software

Bad Debt Expense Formula How To Calculate Examples

Bad Debt Relief Recovery Myobaccounting Com My

Fav Things Abt Chim Pt 1 Bts Texts Bts Memes Funny Kpop Memes

Media Resources Downloads Pembangunan Sumber Manusia Berhad Exemption Of Levy Order 2001 Kwsp 3rd Schedule 7 For Period Apr 2020 To December 2020 Gst Income Tax Forms Gst Forms Epf Kwsp Forms Socso Perkeso Forms News

Illustration Diagram For Output Tax Business Solution Facebook

Gst Sales Purchase Deferred Tax Journal Adjustment Estream Software

Pin By Sharon Roseberry On Lord Of The Rings The Hobbit Really Funny Pictures Really Funny Tumblr Funny

Uparrow Autocount Accounting Version 1 8 19 Release Note Home Release Note Autocount Accounting Version 1 8 19 Release Note December 4 2015 Mohd Imran Release Note No Comments Contents Hide 1 Introduction 2 Improvements

Globla Indirect Tax Services Kpmg Global

Uparrow Autocount Accounting Version 1 8 19 Release Note Home Release Note Autocount Accounting Version 1 8 19 Release Note December 4 2015 Mohd Imran Release Note No Comments Contents Hide 1 Introduction 2 Improvements

Uparrow Malaysian Gst Enhancement 2nd Phase Implementation Home Gst Malaysian Gst Enhancement 2nd Phase Implementation November 6 2014 Mohd Imran Gst No Comments Contents Hide 1 Introduction 2 Input And Output Tax Code